2022-08-31

Money doesn’t make the world go around, (gravity, stars, other planets, and all that other stuff is responsible) but managing the money in your pocket can help you go around the world.

How does one manage one’s money?

About a decade ago, one of my colleagues wanted to go on a European holiday, however, she confessed that she had no idea if she had enough money to go on this holiday or not.

“Bala, I am really poor at money management, besides when you buy a house, all your money, time and attention goes into that,” she said.

I told her “Anything that you measure, can be managed.” So start with measuring.

There are several tech and non-tech solutions for measuring the flow of money. One of the books that put some sense in my head as to what I was measuring is Rich Dad, Poor Dad by Robert Kiyosaki.

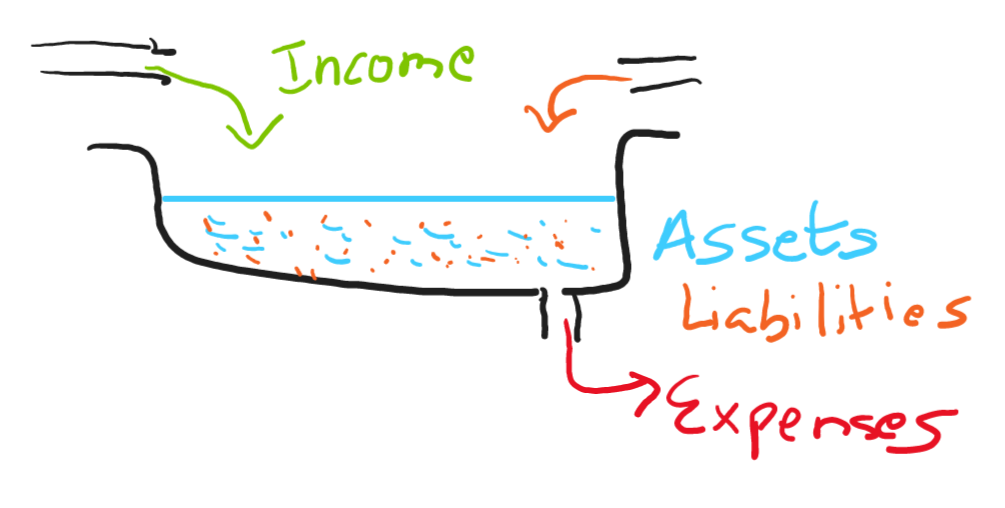

Kiyosaki talks about Assets, Liabilities, Income and Expenses. These are the most important categories, when it comes to measuring the flow of money.

I am going to use a tank as a very useful analogy. Water and milk are our fluids of choice. (Well, technically milk is a colloid and not a fluid per se)

Here is my list of analogies:

- Milk represents income that is yours. (Green arrow into the tank)

- Salary (if you are a salaried employee)

- Business income (if you are a business owner or freelancer)

- Investment income (profit from stock transactions and dividends)

- Bank interest

- Rental income

- Others

- Water represents the liability money that you can spend, but you will have to return at some point of time (Red arrow into the tank)

- Credit cards

- Mortgages (or Equal monthly installments as they are called in India)

- The tank (Assets) is where you hold the milk/water mixture - the various accounts (Blue liquid in the tank)

- Savings

- Checking/current

- Fixed deposits or CDs

- Stock accounts (may include mutual funds)

- Some other form of assets where you can judge the value (Real estate, intellectual property, art, vintage cars, unwashed laundry)

- The amount of milk/water combo that exits the tank represents the expenses. (Red arrow out of the tank)

- Bills

- Food

- School

- Travel

- Others

Some governing factors or rules maybe:

- Assets = the total amount of “pure” milk

- Liabilities = the total amount of water in your tank (If you could use a lactometer, you could measure the amount of water that is in excess of what should be there. Bear with me, the analogy is only going to get weird, but you get the point)

- Income = the amount of milk that entered your tank

- Expenses = the amount of milk/water mixture that left your tank

- Every category should have 5+/-2 categories, so that you don’t get overwhelmed

- You could have subcategories, if your accounting system allows such a thing (Food could have Food:Groceries and Food:DiningOut, for example)

- Assets and Liabilities can be measured at an instant of time, whereas Income and Expenses need to measured over a time period (a week, a month, a year).

- Your employer/clients will pour milk in your tank. Your assets may generate income and that is also accounted under the milk category.

- Sometimes based on how much “milk” you need, you may borrow from sources of Liabilities (credit card, loans)

- It is so difficult to differentiate between Assets and Liabilities in real life, since milk and water are so miscible that it takes tremendous practice and experience to discern “pure” milk from “waterified” milk.

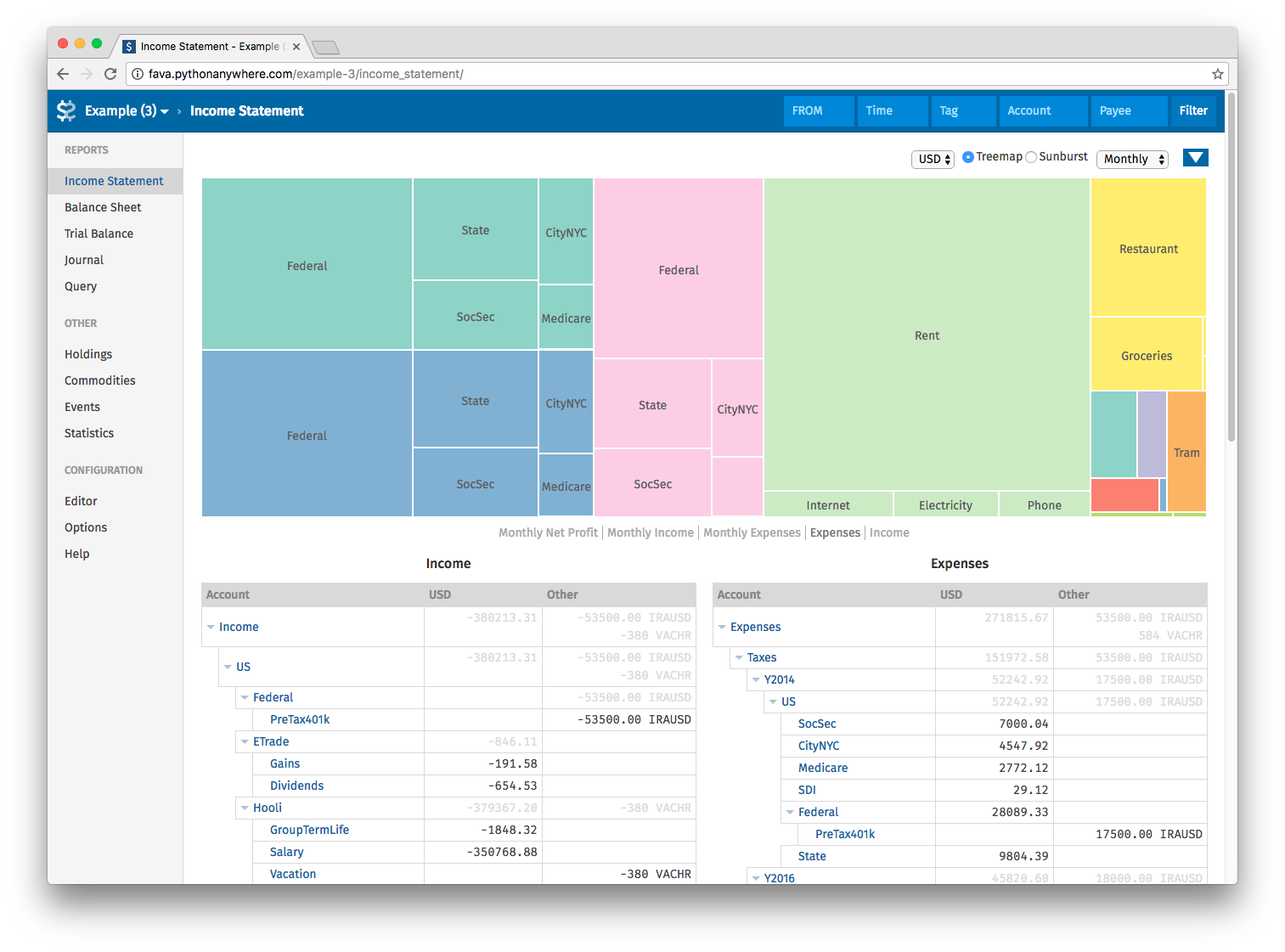

I use a software called Fava (which uses beancount at the heart of it). I recommend you look at https://beancount.github.io/fava/.

Fava is extremely useful, flexible and powerful, but the setup and upkeep for a person with limited or no exposure to programming may require a lot of time.

I used to use Microsoft Money and I found it to be the best software till I found Fava. I’ve used Fava for more than 6 years now.

I’ve tried several other programs and websites (GNUcash, Skrooge, KDEMoney, Toshl, to name a few). I even tried to build my own using Google Sheets and appscript, but Fava gave me the flexibility, utility and geekiness-extreme that I was looking for.

For importing bank statements, I use a python (ever growing codebase) code.

No matter, what the software, if your system is based on the governing rules as mentioned above, you should be good to go.

BTW, I found out recently that my friend had indeed gone on that European holiday that she really really wanted to go and she confessed that it only happened because she managed to manage her personal finances.